TRECENTO

cryptocurrency gained usage in circumventing capital controls and taxes, leading to an increase in demand. Cryptocurrency has been able to present an easy to use digital alternative to fiat currencies. Offering frictionless transactions and inflation control, investors have been prudent enough to add these currencies in their diversified portfolios as an asset, as the size of the market does not represent a systemic risk. Cryptocurrency employs the use of cryptography that assures high-security processes and verifies transactions personal to each user. Hence, counterfeiting and anonymous transactions are impossible to achieve.

While this revolution is gaining wide acceptance, Trecento Blockchain Capital, an all-in-one investment solution that offers services in terms of experience and tools based on blockchain technology has arrived.

Before I take you on this voyage, please check out this video presentation

Now that I have your attention, let’s get right to it.

What exactly is TRECENTO?

Trecento Blockchain Capital is an all-in-one investment solution that offers services in terms of experience and tools based on blockchain technology. The main goal of the platform is to seize the best investment opportunities using blockchain technology, offering its invest the simple and reliable investment platform.

Brief History

Trecento Asset Management is an emerging regulated management company. Following the success of Trecento Asset Management, Trecento SAS group established Trecento Blockchain Capital.

Alice Lhabouz is President of the Trecento SAS group and of Trecento AM her ambition with the launch of Trecento Blockchain Capital is to bring new revolution in Blockchain world. Alice Lhabouz is current CEO of Trecento Blockchain Capital. She put forth her opinion about Trecento Blockchain Capital.

The Aim

The platform is aimed at solving the problems of high level of complexity in the market, the lack of transparency in operations and the lack of a clear regulatory framework, offering an investment approach of 360 degrees. This ensures that users can easily generate profitability while at the same time mitigating the risks associated with investments. Investors are provided with a simple and effective investment solution, offered in a safe and well-regulated environment.

The Problems

The market is growing, bouncing and full of potential returns for investors. But at the same time, it remains difficult to judge, with ongoing innovation and many projects that are either unreal (fraud), or unfeasible. Therefore this market is characterized by a high level of complexity, a strong lack of transparency and a clear regulatory framework. This makes it difficult to understand and therefore invest.

The Solution

Trecento Blockchain Capital has been launched by a team of experienced investment and technology professionals. The goal of Trecento Blockchain Capital is to capture the best business opportunities offered by Blockchain technology through a 360-degree investment approach. Trecento Blockchain Capital aims to provide both individual and institutional investors with a straightforward and performing investment solution that relies on our 4 investment funds. All in safe and orderly living environment.

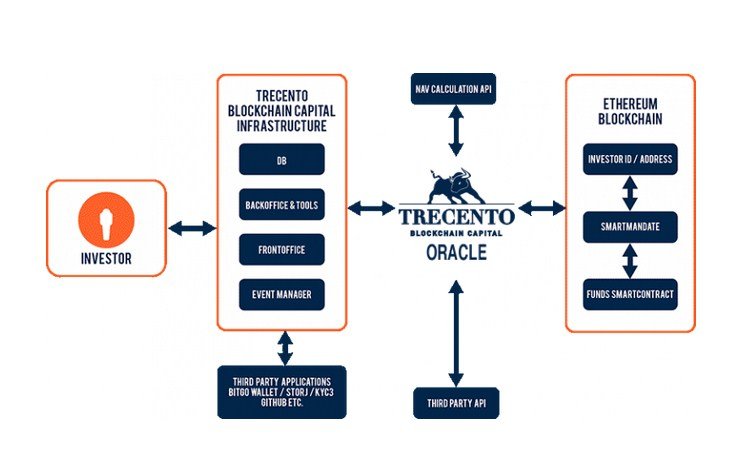

How It work?

Investors register on the online platform of Trecento Blockchain Capital and then execute the procedures of KYC. Then the investor adds his personal ETH-addresses and then fills in the questionnaire on the risk profile for investors. Investors then read, accept and sign an online intellectual mandate. After checking everything is included in the whitelist. Then investors can send their money to a reasonable contract, under which they can order a ransom at any time when they want.

The platform marker, called the Trecento marker (TOT), is a marker that is compatible with the ERC20. Owners of tokens will receive discounts for the execution and management of their fees, as well as receive news, information, and analysis of the market in the blockchain industry. The DAO and voting system allows investors and users to present investment ideas for the platform.

The TOT Technology

Advantages of Trecento Blockchain Capital

360-investment strategy

The platform offers a 360-investment approach that allows platform investors to quickly generate revenue by eliminating risks.

Transparency

The use of blockchain technology ensures that information about all transactions made on the platform is safe and can be easily accessed by all involved.

The Multi-Skilled team

The platform includes a team that has extensive experience in digital investment based on blockchain technology. Platform users are always confident in a true and reliable service. It is thanks to the efforts of developers that customers of the decentralized platform will be able to use all of its functionality. The developers hope to attract investors to the project, who will be able to spend their money on the planned development of the platform. It is already clear that the platform is truly unique and promising with huge opportunities for development. Soon enough, we will all be able to determine how well the developers have managed to realize its full potential.

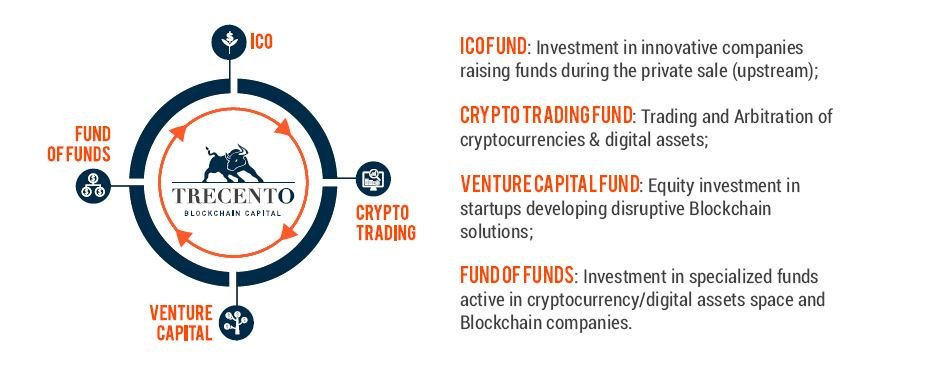

The Capital Funds Trecento Blockchain

The platform contains four thematic funds, which cover the entire investment cycle used by companies that are blockbuster. They include:

ICO Foundation

This fund offers investment in innovative companies that raise funds during a private sale of the company or during an upward flow.

Crypto-trading fund

This fund allows the platform users to trade in crypto-currencies and digital assets

Venture capital fund

This fund provides users with opportunities for equity investments in start-ups that are engaged in the development of destructive blockchain solutions.

Fund of Funds

Users can participate in investing in specialized funds, which are very active in cryptothermines and in blocking companies.

Token Sale and ICO Details

Trecento Tokens (TOT), a utility token, will be sold during the token sale. The TOT token is ERC20 compliant and the total supply is capped with a variable supply. TOT tokens will be sold at the rate of 1EUR to 1 TOT token. The private sale is currently on, with a 30% discount but, closes on 30th September or as soon as soft cap is achieved.

Token Details

Token name: Trecento Token

Ticker: TOT

Token type: Utility Token

Token standard: ERC-20

Type of supply: Capped FCBS-basis, variable supply

ICO Price: €1 (EUR)

Soft cap: €5mn (5 million euros)

Hard cap: €20mn (20 million euros)

ICO duration: June, 1st – September, 30th 2018

Currencies accepted BTC/ETH/LTC/DASH/DODGE & FIAT money (USD, EUR, etc.)

The ICO is live on with 30% bonus on offer at the moment. Do participate. Note that, rate and conversion are calculated every minute. The following picture shows the phases of the ICO, their dates, minimum accepted investment and the bonuses available.

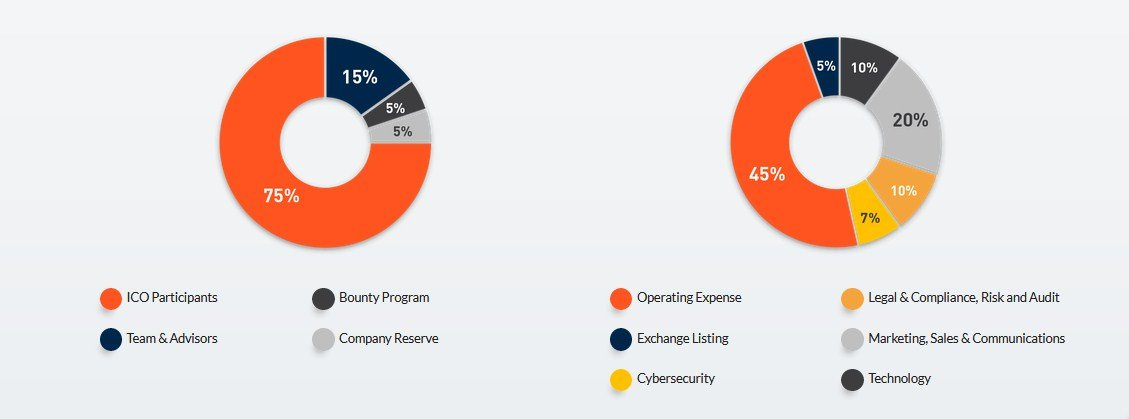

Token Distribution

75% – ICO Participants

15% – Team & Advisors

5% – Bounty program

5% – Company reserve

Use of proceeds

48% – Operating Expense

20% – Marketing sale & Communication

10% – Technology

10% – Legal & Compliance, Risk & Audit

7% – Cybersecurity

5% – Exchange listing

ROADMAP

2017

Market Analysis

Feasibility & Technical study

Legal & Compliance study

Strategy & Business Plan

2018

WhitePaper and ICO documents

Advisors selection

ICO campaign (roadshows in Blockchain events)

DAO development

Application and approval of Trecento Blockchain Capital (FINMA)

Working with European regulators on funds Tokenization

Technological tools & Dashboard development

Funds Smart Contract development, Audit & Security verification

Strenghtening of the team and new talents hiring

2019

Distribution agreements with International partnerships

Funds Smart Contracts implementation

Launch of Trecento Blockchain capital funds (ICO, Crypto, Trading, VC)

Closing of the Venture Capital Fund

Beta version of the DAO

2020

New Office openings across Asia, Middle East and North America

Additional talents hiring

New Blockchain thematic funds.

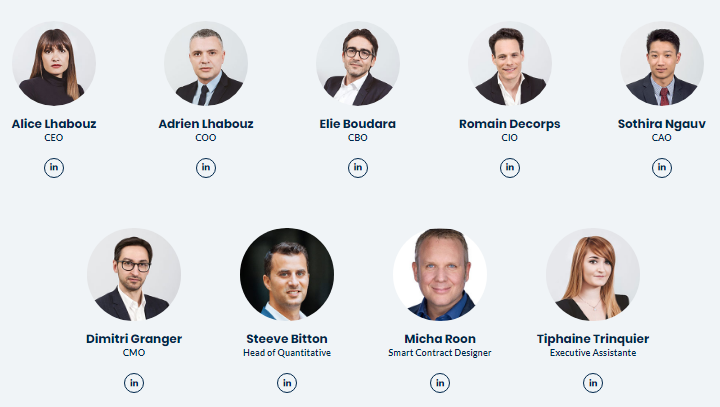

Meet The Amazing Team

Adrien Lhabouz: Partner – Chief Operating Officer

Elie Boudara: Partner – Chief Blockchain Officer

Romain Decorps: Partner – VC CIO & Head of Strategic Partnerships & International Development

Steeve Bitton: Partner – Head of Quantitative Department

Sothira Ngauv: Partner – Chief Analysis Officer

Dimitri Granger: Chief Marketing Officer

Micha Roon: Smart Contracts Designer

Tiphaine Trinquier: Executive Assistant

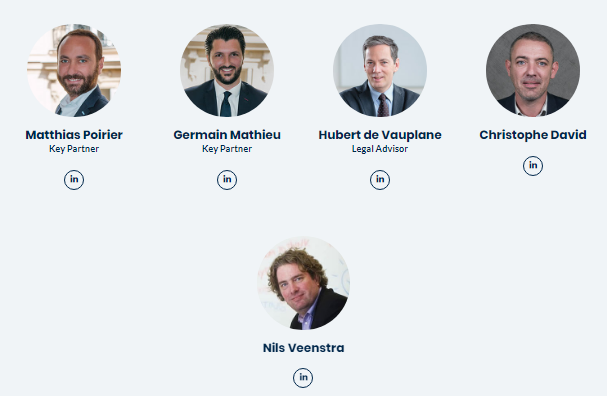

ADVISORS AND KEY PARTNERS

Hubert De Vauplane: (Advisor) Lawyer & Partner at Kramer-Levin

Matthias Poirier: (Key Partner) Founder of MPG Partners, a Management Consulting firm specialized in Financial services

Germain Mathieu: (Key Partner) Founder of MPG Partners, a Management Consulting firm specialized in Financial services

Nils Veenstra

Christophe David

Be a part of this incredible project. Download the whitepaper for the full scoop.

Till next time…

For more information, please visit:

Website: http://trecento-blockchain.capital/

Whitepaper: https://ico.trecento-blockchain.capital/wp-content/uploads/2018/05/TrecentoBC-Whitepaper.pdf

ICO Website: http://ico.trecento-blockchain.capital/

Facebook: https://facebook.com/trecentoBC/

Twitter: https://twitter.com/TrecentoBC

Telegram: http://t.me/trecentobcroom , http://t.me/trecentobc

Author: johnthedon

BitcoinTalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1860087

Comments

Post a Comment