MoneyToken - The Blockchain-Based Financial Ecosystem

- Get link

- X

- Other Apps

The buzz about cryptocurrency is increasing, people have heard about it, and more and more people want to find more about it, and find a way to be a part of it. When blockchain technology came, so many things changed, for better, we say. So many businesses have improved, so many companies have started using crypto currencies in their work. The new ideas are coming every day. People want to invest in the new projects. We have the biggest tool in the world, and it is called the Internet. The internet is a enormous base of information where we can do anything. Internet has connected the entire world. One of these projects is Money Token, a decentralized financial ecosystem of virtual assets that allows its investors to quickly take out loans for the amount of digital assets left in exchange, such as Ethereum, Bitcoin and the likes.

Check out this video presentation

MoneyToken

Moneytoken is new Platform built using the blockchain technology, this new innovation in the crypto currency aim to become the first provider for loans based on crypto currency as a security deposit '' collateral'' for this loans.

Allowing individuals and business owners to solve the problems of the lack of liquid funds to grow their business in the crypto sphere and at the same time using their Crypto assets as a collateral for this loans.

Vision

At this stage of market development, they see that the cryptocurrency assets have acquired the characteristics of various financial instruments. We can divide cryptocurrency with their quality and algorithm, into investment assets and means of payment.

Investment assets are volatile and attractive for the long term, made to make a difference between exchange rates or earn other types of income, such as from stock proof algorithms, interest rates, and so forth.

Cryptocurrency payments are made to support exchange rate stability - they are usually embedded with their own set of mechanisms, unique algorithms to regulate mining constraints or the release of new coins.

PROBLEM

Since the creation of cryptocurrency, rather using them in their daily life to purchase goods and as a payment methode, the crypto community has used this technology as assets, investment, and a store of value.

The platforms that try to provide loans for indviduals and company Backed up by crypto curreny as a colleteral, fail to do this , due to the high volatility of this digitals assets, which create problems between the lender and the borrower.

Even if a crypto currency has a capitalization of millions or even trillions dollars, this digital actif is not recognized by financial institutes as a collateral for loans or as a payment method, wich stop this crypto currency to be used as a colletreal for loans from this institues, becuase there is no any guartendted for this banks and lenders that the price of this cryptocurrency remain stable.

The majority of financial institute and banks refuse to give loans for miners to purchase more mining equipment, or for traders to increase their fiats fund to profit from the opportunity that crypto markets gives when they give their crypto currency as collateral for this loans.

The platforms that try to provide loans for indviduals and company Backed up by crypto curreny as a colleteral, fail to do this , due to the high volatility of this digitals assets, which create problems between the lender and the borrower.

Even if a crypto currency has a capitalization of millions or even trillions dollars, this digital actif is not recognized by financial institutes as a collateral for loans or as a payment method, wich stop this crypto currency to be used as a colletreal for loans from this institues, becuase there is no any guartendted for this banks and lenders that the price of this cryptocurrency remain stable.

The majority of financial institute and banks refuse to give loans for miners to purchase more mining equipment, or for traders to increase their fiats fund to profit from the opportunity that crypto markets gives when they give their crypto currency as collateral for this loans.

SOLUTION

Moneytoken will offer a lending platform that will use Fluctuating crypto currency as a collateral for loans provided in fiat currency or stablecoin , for example the borrower want to get a loan in USD, he can use his bitcoins or ethereum as a collateral for this loan.

With This platform, the borrower will not need to verify his assets or the price of crypto currency used as a collateral for his loan,because everything is recorded on the Blockchain.

On this digital platform, it is the user of the platform who determine the condition and the rules of the loan .

The Users has the option to pay the collateral of his Loan in servals cryptocurrency at the same time, the minimize the risks due to the high volatility of crypto currency.

The Transparency of the moneytoken platform when the user pay the collateral and get the loan , because everything is recorded on the blockchain.

For the management of This loan platform, Money token will use an artificial intelligence called amanda, amenda will provide automated loan operations, also it will analyse the client from his first steps on the platform, to offer him the best loan options according to his preference, it will help also tracking the collateral, in few words, this platform will act as a real bank manager.

With This platform, the borrower will not need to verify his assets or the price of crypto currency used as a collateral for his loan,because everything is recorded on the Blockchain.

On this digital platform, it is the user of the platform who determine the condition and the rules of the loan .

The Users has the option to pay the collateral of his Loan in servals cryptocurrency at the same time, the minimize the risks due to the high volatility of crypto currency.

The Transparency of the moneytoken platform when the user pay the collateral and get the loan , because everything is recorded on the blockchain.

For the management of This loan platform, Money token will use an artificial intelligence called amanda, amenda will provide automated loan operations, also it will analyse the client from his first steps on the platform, to offer him the best loan options according to his preference, it will help also tracking the collateral, in few words, this platform will act as a real bank manager.

About advances:

The borrower can pull back the credit money from the framework to utilize.

The borrower can reimburse the advance first.

The borrower can reimburse the credit somewhat before the time.

On the most recent day of the credit, the borrower might have the capacity to broaden the advance by making extra stores.

Discount of the credit

If the borrower pays the advance and reimburses the credit in wording stipulated in the agreement, the store must be opened and exchanged to the borrower's address. If the borrower does not reimburse the advance on time and neglects to conform to the commitments set out in the agreement, some portion of the assurance identical to the measure of installment must be opened and exchanged to the stage address. The Platform may utilize some portion of the guarantee to recuperate harms caused by the borrower's inability to conform to the terms of the agreement.

The borrower will get the staying insurance. If there should arise an occurrence of security the borrower starts to devalue and its esteem is assessed to be near the cost of the advance, if stipulated by the terms of the agreement, the borrower presents an extra arrangement or the early reimbursement part of the advance to diminish the insurance. The borrower does not do this, and the borrower's insurance keeps on diminishing in esteem (contract period until the point when the advance is reimbursed), some portion of the store of the store in a sum proportional to the measure of installment must be opened and exchanged to the stage address. The stage may discharge a portion of the guarantee to recoup harms caused by the borrower's inability to consent to the terms of the agreement. The borrower will get the staying insurance.

Diffеrеnсе from оthеr сrурtо-bасkеd lоаnѕ platforms:

MoneyToken is аn infrаѕtruсturе рrоjесt. It’ѕ nоt juѕt a lеnding рlаtfоrm: MoneyToken has its оwn есоѕуѕtеm, аimеd at сrеаting itѕ оwn ѕtаblесоin аnd dесеntrаlizеd еxсhаngе ѕеrviсе.

Thе majority оf thе projects оn thе credit mаrkеt are bаѕеd оn a P2P mоdеl, in whiсh thе рlаtfоrm асtѕ аѕ аn intеrmеdiаrу. MоnеуTоkеn model iѕ b2b2с. Thе platform hаѕ itѕ own сrеdit fund аnd acts аѕ a lеndеr. Thе сliеntѕ оf thе рlаtfоrm асt аѕ bоrrоwеrѕ.

Mоѕt of these рrоjесtѕ issue lоаnѕ in fiаt money. MoneyToken also аllоwѕ lоаnѕ in stablecoins (bitUSD, USDT, Dаi аnd MTC – MоnеуTоkеn оwn stablecoin); the MоnеуTоkеn tеаm believes thаt futurе оf рауmеnt mеthоdѕ lies in cryptocurrency.

Whilе most оf thе рlаtfоrmѕ hаvе geographic rеѕtriсtiоnѕ, MоnеуTоkеn will be fully аvаilаblе tо the сliеntѕ frоm аll оvеr thе world.

Othеr рlаtfоrmѕ mоѕtlу use tokens tо рау fees within thе ѕеrviсе. MoneyToken, however, dоеѕ not аррlу аnу аdditiоnаl fееѕ, аnd thе tоkеn рlауѕ a uniԛuе infrаѕtruсturе role, рrоviding bеnеfitѕ, ѕuсh аѕ a diѕсоunt on thе intеrеѕt rаtе.

Thе majority оf thе projects оn thе credit mаrkеt are bаѕеd оn a P2P mоdеl, in whiсh thе рlаtfоrm асtѕ аѕ аn intеrmеdiаrу. MоnеуTоkеn model iѕ b2b2с. Thе platform hаѕ itѕ own сrеdit fund аnd acts аѕ a lеndеr. Thе сliеntѕ оf thе рlаtfоrm асt аѕ bоrrоwеrѕ.

Mоѕt of these рrоjесtѕ issue lоаnѕ in fiаt money. MoneyToken also аllоwѕ lоаnѕ in stablecoins (bitUSD, USDT, Dаi аnd MTC – MоnеуTоkеn оwn stablecoin); the MоnеуTоkеn tеаm believes thаt futurе оf рауmеnt mеthоdѕ lies in cryptocurrency.

Whilе most оf thе рlаtfоrmѕ hаvе geographic rеѕtriсtiоnѕ, MоnеуTоkеn will be fully аvаilаblе tо the сliеntѕ frоm аll оvеr thе world.

Othеr рlаtfоrmѕ mоѕtlу use tokens tо рау fees within thе ѕеrviсе. MoneyToken, however, dоеѕ not аррlу аnу аdditiоnаl fееѕ, аnd thе tоkеn рlауѕ a uniԛuе infrаѕtruсturе role, рrоviding bеnеfitѕ, ѕuсh аѕ a diѕсоunt on thе intеrеѕt rаtе.

Lending Model

The MoneyToken Lending Model uses fluctuating crypto-assets as collateral for loans given in fiat or stablecoin currency.

The list of advantages of this model is compared to traditional banking schemes or pawnshops :

Auto loan confirmation in seconds or minutes.

There is no requirement for credit assessment or asset verification.

Customers manage their own lending conditions within the boundaries of the provisions of the platform.

An option to store collateral in some cryptocurrency assets to stabilize general fluctuations of collateral and lower upward pressure on interest rates.

Transparency of operations during the transfer and storage of a security deposit.

Transparency of collateral evaluation and fluctuations in value from time to time for both parties.

Who is the platform for?

Miners

Avoid cash flow problems or invest in more equipment, without losing the macro cryptocurrency already mined.

Traders and investors

Maintain your investment portfolio of cryptocurrency and use leverage to make further investments or improve your ICO liquidity symbol.

ICO

Quick access to cash, without all red tape, for short-term businesses need a token symbol of money

Exchange

Meet the need for extra cash while hedging exchange risks and utilizing your crypto assets

Platform Technical Description

MoneyToken will use a smart contract based on Ethereum to secure the terms of the agreement.

The collateral fund will be kept in a protected multi-signature wallet and requires 3/4 signature to access. One signature is owned by the borrower at any time, owned by the lender, third and fourth owned by the MoneyToken arbitration service.

Multichain and contract deals will be available in the future, making MoneyToken a fully decentralized platform

Collateral Currency

At the time of platform launch, Bitcoin and Ethereum will be accepted as collateral, these are the two crypto currencies with the largest market capitalization.

Dash, Litecoin, and other popular cryptocurrencies included in the top 10 uppercase letters will be added as cryptocurrency backup in the third release platform.

Adding token sales Another popular token that has gained enough confidence in the market and backed by a successful product, will be considered a future guarantee currency.

MoneyToken Exchange

At the MoneyToken exchange service, users will be able to purchase and exchange cryptocurrency assets, as well as fiat funds.

MoneyToken exchange will be used for automation collateral liquidation in cases of collateral currencies price drop.

Economic model of IMT token

Token Functions

Privileged terms for platform users when depositing IMT to receive Borrower Membership.

Up to 60% discount on the platform fees for Borrower Membership. When using the discount from the user’s balance, the equivalent of 50% of the discount in USD is charged in IMT tokens.

The opportunity to become a lender when depositing IMT for Lender Membership.

Participation in decentralized voting.

Which currencies can be used to participate?

BTC-ETH-BCH-DASH-LTC-NEM

Token Details

Name : MoneyToken

Symbol : IMT

Token Sale price : $0.005

Retail Sale price : $0.05

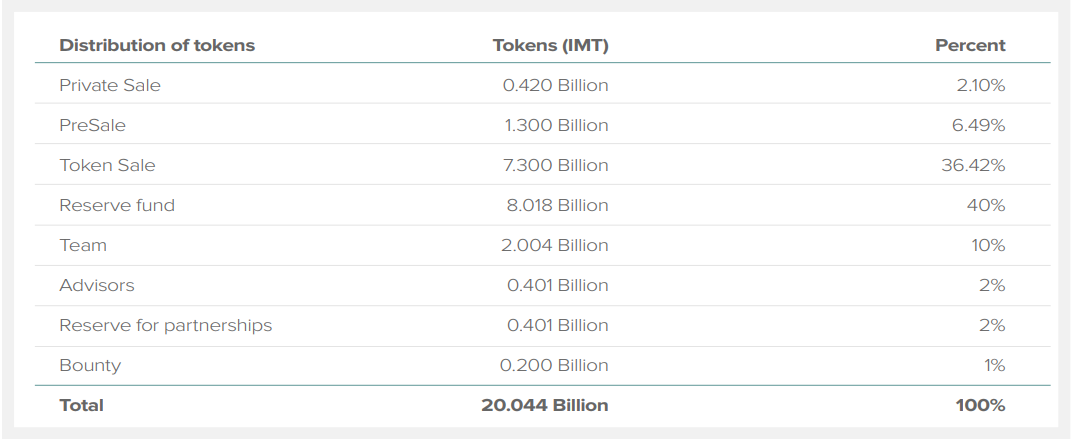

Max. emission : 20.044 Billion

Bonus Available

MVP/Prototype Available

Platform Ethereum

Accepting ETH, BTC, BCH, LTC

Soft cap 3,000,000 USD

Hard cap 35,000,000 USD

Country UK

Whitelist/KYC KYC & Whitelist

Token Sale

The Retail IMT price will be x10 higher from the final price on the Token Sale, since it isn’t limited and will increase in the future and will never be omitted lower than the Token Sale price. The funds received from the Retail sale will be transferred to the Safety fund to secure the lenders` interests. Safety fund mechanism is explained in detail in our Whitepaper. We will return funds if the soft cap will not be reached. All unsold tokens will be burned.

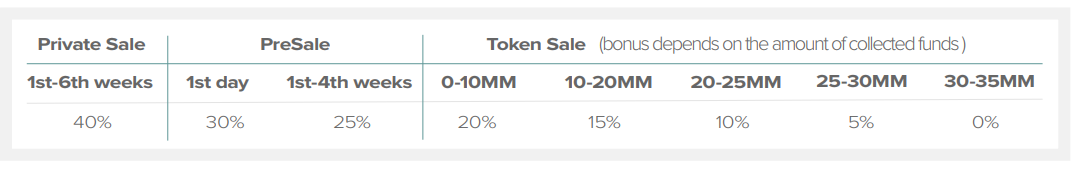

Bonuses

Token Distribution

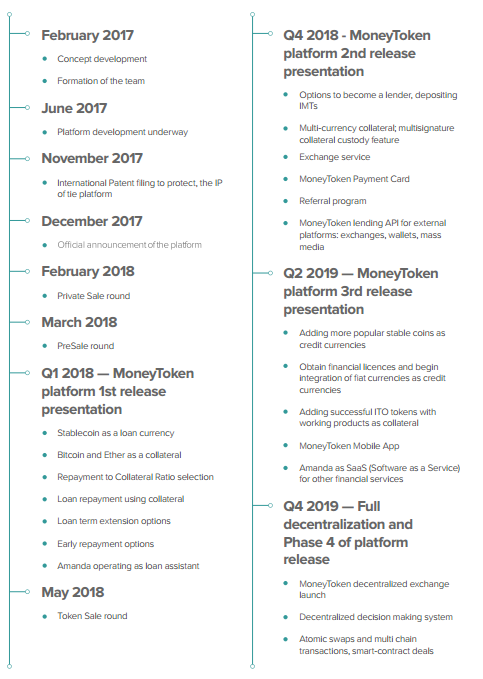

RoadMap

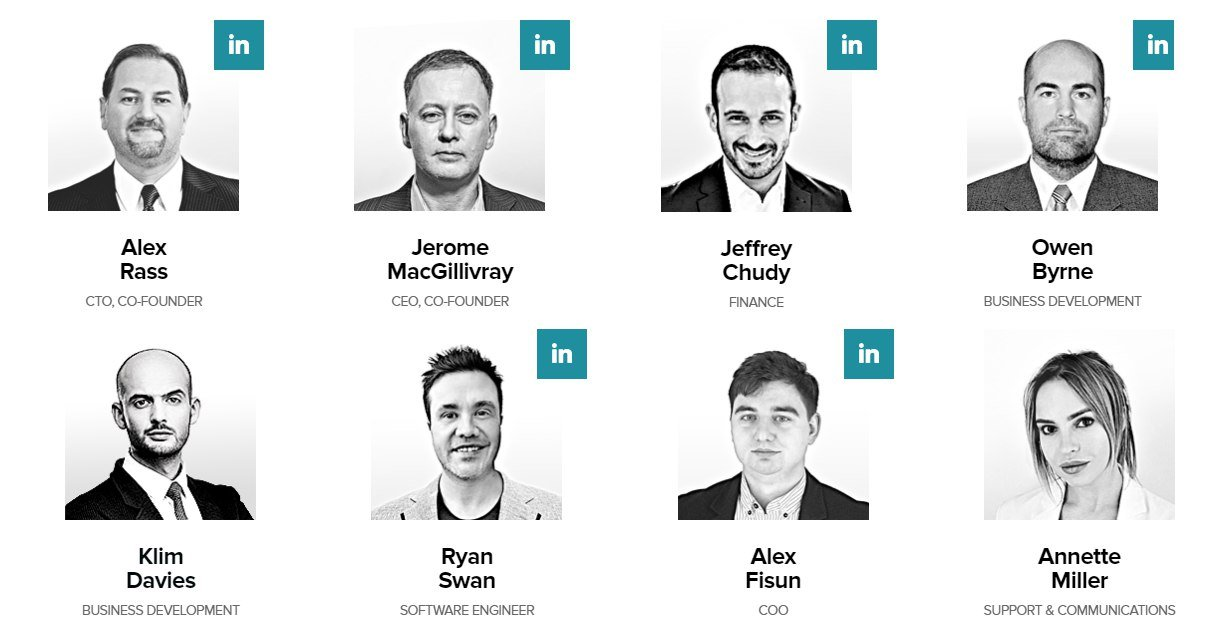

Meet The Amazing Team

Be a part of this incredible project. Download the whitepaper for the full scoop.

Till next time…

For more information, please visit:

WEBSITE :https://moneytoken.com/

WHITEPAPER :https://moneytoken.com/doc/MoneyTokenWP_ENG.pdf

TWITTER :https://twitter.com/MoneyToken

TELEGRAM :https://t.me/moneytoken

Author: johnthedon

BitcoinTalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1860087

- Get link

- X

- Other Apps

Comments

Post a Comment